The Best Guide To Clark Wealth Partners

Wiki Article

What Does Clark Wealth Partners Do?

Table of ContentsThe smart Trick of Clark Wealth Partners That Nobody is Talking AboutClark Wealth Partners Can Be Fun For Everyone7 Simple Techniques For Clark Wealth PartnersIndicators on Clark Wealth Partners You Should KnowWhat Does Clark Wealth Partners Do?The Greatest Guide To Clark Wealth PartnersAll About Clark Wealth Partners4 Easy Facts About Clark Wealth Partners Shown

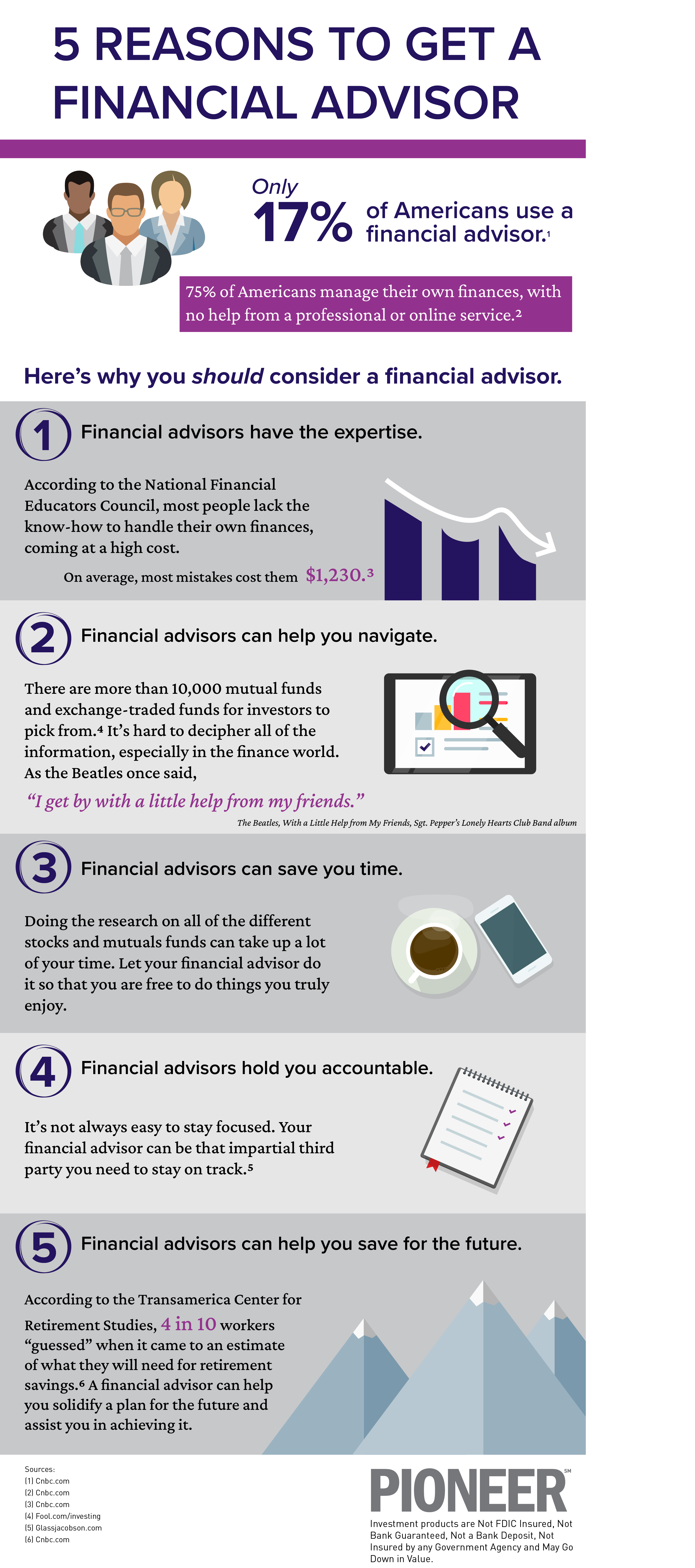

Usual factors to think about an economic consultant are: If your monetary circumstance has actually become extra complex, or you do not have self-confidence in your money-managing abilities. Saving or browsing significant life events like marriage, separation, youngsters, inheritance, or job adjustment that may significantly affect your economic situation. Navigating the shift from conserving for retired life to preserving wide range during retirement and how to develop a solid retired life income strategy.New technology has led to more extensive automated financial tools, like robo-advisors. It depends on you to check out and determine the right fit - https://244461241.hs-sites-na2.com/blog/how-financial-advisors-illinois-can-shape-your-financial-future. Inevitably, an excellent monetary consultant should be as conscious of your investments as they are with their very own, preventing excessive costs, conserving money on taxes, and being as transparent as possible about your gains and losses

The 20-Second Trick For Clark Wealth Partners

Gaining a compensation on item recommendations doesn't always mean your fee-based consultant antagonizes your ideal rate of interests. They might be a lot more likely to suggest products and services on which they make a payment, which may or may not be in your ideal passion. A fiduciary is legitimately bound to put their customer's rate of interests.They might follow a loosely monitored "viability" requirement if they're not signed up fiduciaries. This basic permits them to make recommendations for financial investments and solutions as long as they suit their customer's goals, danger resistance, and monetary situation. This can convert to suggestions that will also earn them money. On the various other hand, fiduciary experts are lawfully bound to act in their client's finest passion as opposed to their very own.

Some Known Facts About Clark Wealth Partners.

ExperienceTessa reported on all points spending deep-diving into complex financial subjects, clarifying lesser-known financial investment methods, and discovering ways viewers can work the system to their benefit. As an individual money expert in her 20s, Tessa is acutely conscious of the influences time and unpredictability have on your financial investment choices..jpeg?width=386&height=338&name=6%20Money%20Decisions%20Graphic%20(R).jpeg)

It was a targeted ad, and it worked. Review extra Check out less.

The smart Trick of Clark Wealth Partners That Nobody is Talking About

There's no solitary path to becoming one, with some individuals beginning in financial or insurance coverage, while others begin in accountancy. A four-year degree offers a strong foundation for careers in financial investments, budgeting, and client services.The Clark Wealth Partners PDFs

Usual instances consist of the FINRA Series 7 and Series 65 examinations for securities, or a state-issued insurance permit for offering life or medical insurance. While qualifications might not be legally needed for all intending roles, employers and customers often see them as a benchmark of professionalism and reliability. We look at optional qualifications in the following section.Most financial coordinators have 1-3 years of experience and knowledge with monetary items, conformity standards, and direct client interaction. A solid academic background is crucial, but experience shows the capacity to use concept in real-world setups. Some programs integrate both, allowing you to complete coursework while making monitored hours via internships and practicums.

How Clark Wealth Partners can Save You Time, Stress, and Money.

Several get in the area after functioning in banking, audit, or insurance coverage, and the shift calls for perseverance, networking, and frequently advanced credentials. Early years can bring lengthy hours, stress to develop a client base, and the need to constantly show your knowledge. Still, the profession provides solid long-lasting possibility. Financial planners appreciate the opportunity to function carefully with clients, overview essential life decisions, and often attain versatility in routines or self-employment.

Wide range managers can boost their revenues via compensations, property charges, and performance incentives. Financial managers manage a group of economic organizers and advisers, setting departmental technique, taking care of compliance, budgeting, and guiding internal operations. They invested much less time on the client-facing side of the market. Almost all monetary managers hold a bachelor's level, and many have an MBA or comparable graduate degree.

The Ultimate Guide To Clark Wealth Partners

Optional certifications, such as the CFP, generally call for extra coursework and screening, blog here which can prolong the timeline by a number of years. According to the Bureau of Labor Statistics, individual financial advisors earn a typical annual annual salary of $102,140, with leading income earners gaining over $239,000.In other provinces, there are laws that need them to fulfill particular requirements to utilize the economic advisor or economic coordinator titles. For financial coordinators, there are 3 common designations: Certified, Personal and Registered Financial Organizer.

Clark Wealth Partners Can Be Fun For Everyone

Where to locate a monetary consultant will depend on the kind of recommendations you require. These organizations have staff that might assist you comprehend and get particular types of financial investments.Report this wiki page